I pay a lot in property taxes. Why doesn’t that fund the schools? (AKA – the effect of Prop 13)?

Most California schools have not been funded by local property taxes since the passage of Prop 13 in 1978. Prop 13 had the effect of reducing property tax rates on homes and businesses by nearly 60% and effectively shifted control of school funding from local communities to the California state government. While new Piedmont homeowners are paying about market rate for their property taxes, a large percentage have been in their homes for decades and are paying much less. If PUSD were the direct recipient of all Piedmont property taxes, that amount would total far less than what we currently receive from the government. This is true for all but a handful of school districts in California.

What led up to Prop 13 and what are the ramifications?

In the 1950s and 1960s, California’s per-pupil spending was among the highest in the nation. Communities controlled funding to their schools. This often meant that the school districts would set their budgets, provide that information to the country, and the county would use that need to assist in setting property tax rates. This led to vast education inequality, with more affluent communities spending three or four times as much per student than poor communities. In the mid-1970s, a compromise of a sort was reached which limited state spending to a few thousand dollars per student. California dropped to about 15th in per-pupil spend.

In 1978, California passed Prop 13 which led to property taxes being based on the assessed rate, and not the market value of the property, with reassessment only required on the transfer of property, excluding in-family property transfers. California schools lost about a third of their funding overnight. By the early 1990s, California per-pupil spending was at 80% of the national average. Today California ranges between 41st and 46th in the country in terms of student spending. The state is similarly ranked among the lowest in teacher/pupil ratio, reading and math scores, and college readiness.

How are my property taxes calculated and where do they go?

California is still using Prop 13’s definitions for property tax assessments. Residents pay 1% of their property’s value for real property taxes. This value is set at the property’s assessed value at the time of the property’s purchase. This 1%, shown as the “Countywide Tax” on your bill goes to Alameda County, to be distributed based on a statewide formula. Much of it goes into the county education fund, which is then augmented by state funds and distributed to the districts.

In addition to the 1% Countywide Tax, most homeowners will also see items under “Voter Approved Debt Service.” These are additional taxes that voters passed at the ballot box. In Piedmont, the H1 Bond to fund a new high school is listed at a 0.1243% tax rate. Other bonds are county or district-based. These funds go directly to the debt relief requirements passed by the voters.

What about parcel taxes?

If you look at the right side of your property tax bill, you’ll see a “Fixed Charges and/or Special Assessments” section. These are direct levies or parcel taxes. Parcel taxes became popular in California after the passage of Prop 13 as a way for schools and cities to function after the loss of so much property tax revenue. Piedmont has several such taxes, including taxes on local and county-wide services, as well as two school parcel taxes. Measure G (previously Measure A) began in July 2020 and is a flat fee paid annually by property owners. It gets distributed directly to the Piedmont Unified School District. The Parcel Tax funds 27% of the district’s budget. Measure H, also passed in 2020, approved a special parcel tax of $0.25 per square foot on building improvements, providing as much as $2.6 million earmarked for funding to attract and retain high quality teachers and educational support staff at Piedmont schools.

The city seems pretty flush with funds because of the money that comes from transfer tax revenue. Why can’t they give some to the schools?

The City’s primary source of revenue comes from property-related taxes, which includes the transfer tax. The City of Piedmont, like School Districts and cities across California, faces challenges, including underfunded liabilities related to pensions and other post-retirement benefits, as well as a critical need to address issues related to the condition of its facilities and infrastructure. For Piedmont, this includes needed repairs and renovations to Veteran’s Hall, the Recreation Center, Community Center, the Community Pool, and parks and play fields.

There is an ongoing need to maintain and improve streets and sidewalks, as well as the City’s storm-drain system. Given the cyclical nature of real estate and property-related values, the impact that has on City revenue, and the consistent need to deliver quality services and to improve infrastructure, the City is budgeting responsibly and is not in a position to transfer portions of its tax revenue to the schools.

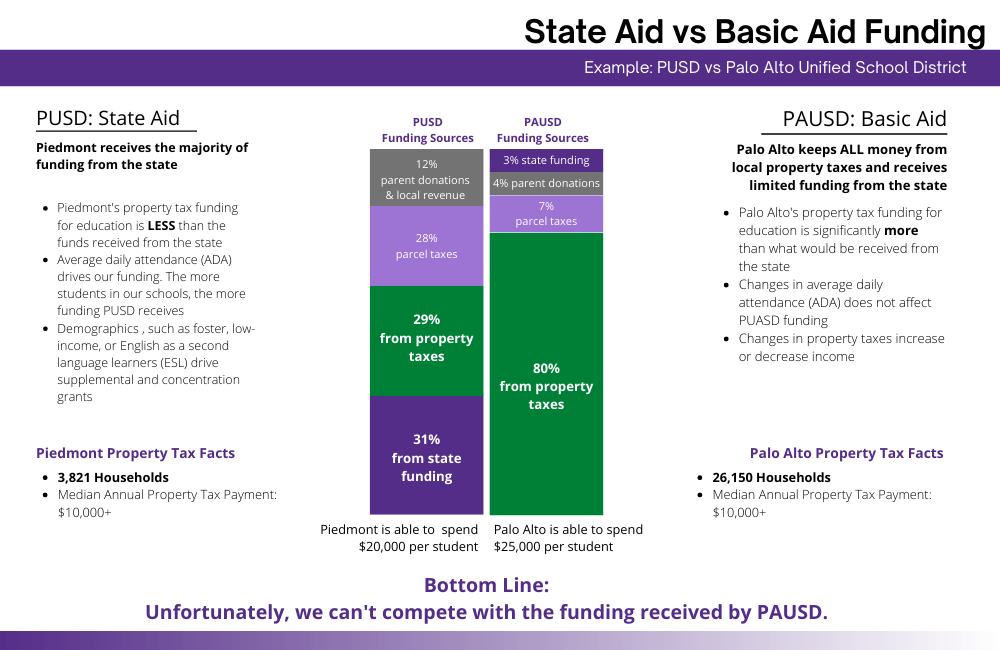

What is a basic aid district and why doesn’t Piedmont qualify?

Comparisons between PUSD and other districts can be difficult. While our schools appear similar and provide a similar education, funding sources can be completely different. It is important to understand that PUSD is funded, primarily, by state funds. Many districts that are compared to ours are actually Basic Aid districts.

Districts are automatically funded under the Basic Aid model when their property taxes surpass the amount of unrestricted dollars the state would have provided through the Local Control Funding Formula (LCFF). This means they get to keep all local property taxes, and receive a small amount from state and federal sources. Basic Aid districts, including Palo Alto, Mountain View-Los Altos, and Santa Clara, receive significantly more funds than LCFF districts like Piedmont.

Most California schools have not been funded by local property taxes since the passage of Prop 13 in 1978. Prop 13 had the effect of reducing property tax rates on homes and businesses by nearly 60% and effectively shifted control of school funding from local communities to the California state government. While new Piedmont homeowners are paying about market rate for their property taxes, a large percentage of our community have been in their homes for decades and are paying much less. The reality is, if PUSD were the direct recipient of all Piedmont property taxes, that amount would be far less than what we currently receive from the government. This is true for all but a handful of school districts in California.